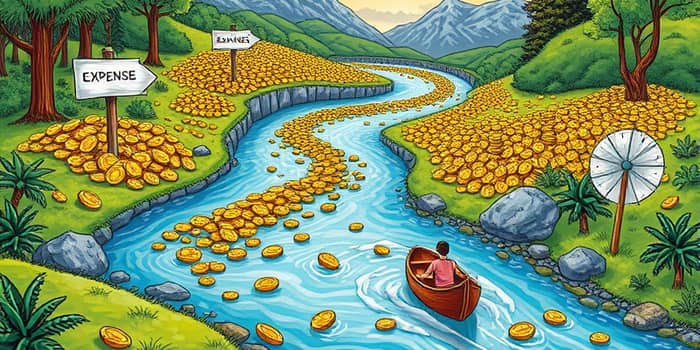

Effective budgeting empowers individuals and businesses to navigate financial challenges with confidence. By treating money as a strategic resource, one can create paths toward meaningful goals.

Introduction to Budgeting and Money Flow

At its core, budgeting is the act of planning how to allocate resources to match income with expenses. This process helps in controlling finances and reaching goals over time.

When properly managed, your budget becomes a roadmap to build emergency funds, avoid debt, and pursue dreams like homeownership, travel, or secure retirement.

Core Steps in Personal Budgeting

Mastering budgeting involves a structured sequence of actions. Each step builds on the previous one, creating a cohesive plan tailored to your unique situation.

- Determine your take-home pay after deductions, including taxes and retirement contributions.

- Monitor every expense using accurate categorization tools, separating fixed and variable costs.

- Prioritize financial goals like savings or debt reduction to guide allocation.

- Use budgeting system such as the 50/30/20 rule or zero-based budgeting.

- Regularly review spending and adjust categories as needed to stay balanced.

Following these steps consistently turns budgeting from a chore into a powerful habit that guides daily decisions.

Tools and Methods for Tracking

In today’s digital age, a variety of tools can simplify the budgeting process. Budgeting apps like Mint and You Need a Budget offer intuitive dashboards and real-time syncing with bank accounts.

Alternatively, detailed spreadsheets or bank-provided tools can deliver the same insights for those who prefer a hands-on approach. Small business owners often rely on comprehensive cash flow statements generated by accounting software to track inflows and outflows.

Forecasting upcoming expenses—such as home repairs or seasonal costs—enables you to allocate funds proactively, avoiding last-minute shortfalls.

Strategies to Master Cash Flow

Whether for personal finances or business, mastering cash flow revolves around maintaining liquidity and minimizing unnecessary outflows.

On a personal level, adopt systematic saving habits on autopilot by setting aside a fixed percentage of each paycheck. Automate these transfers so saving becomes effortless.

For those with debt, consider consolidation to reduce interest charges, or accelerate payments when possible to shorten repayment timelines.

Business owners can strengthen cash flow by negotiate longer payment terms with suppliers, delaying nonessential purchases, and consolidating accounts to prevent idle balances.

Budgeting Approaches and Popular Rules

These frameworks provide guardrails. Experiment to discover which aligns best with your lifestyle and financial personality.

Common Budgeting Challenges and Solutions

Even the most diligent planners face obstacles. Recognizing these challenges is the first step toward overcoming them.

- Irregular income can make planning unpredictable. Base your budget on the lowest expected figure, then allocate bonuses or extras to savings.

- Overspending on discretionary items often stems from untracked habits. Identify budget “leaks” such as dining out, subscriptions, or impulse purchases.

- Lack of discipline may derail your plan. Use automation, accountability partners, and apps that send alerts to maintain momentum.

- Failure to adapt can leave you unprepared for life changes. Events like promotions or layoffs require immediate budget reviews to stay resilient.

Example Benchmarks and Targets

As a rule of thumb in the U.S., many spend 50–60% of income on needs, 20–35% on wants, and dedicate 10–20% to savings or debt repayment. Keep in mind these ratios may shift based on personal priorities.

A robust emergency fund typically covers three to six months of living expenses. Even if you start small, consistent contributions will grow your safety net over time.

Experts recommend aiming for a 20% savings rate, though any positive habit builds financial discipline and peace of mind.

Advanced Tips for Budget Optimization

Once the basics are mastered, elevate your budgeting prowess with these tactics:

- Negotiate recurring costs like insurance premiums, subscription fees, and utility rates.

- Regularly audit bank statements for hidden charges and cancel unused services.

- Leverage predictive analytics tools for accurate forecasting and scenario planning.

Small refinements can yield substantial annual savings when compounded over time.

Conclusion: Budgeting as a Lifelong Journey

Budgeting is not a one-time exercise but an ongoing practice that evolves with your goals and circumstances. Embrace flexibility, celebrate milestones, and view each adjustment as progress.

By approaching your finances with intention and using the strategies outlined, you can transform money management into a journey of empowerment, enabling you to pursue aspirations with confidence.

References

- https://bettermoneyhabits.bankofamerica.com/en/saving-budgeting/creating-a-budget

- https://tipalti.com/resources/learn/cash-flow-management/

- https://www.nerdwallet.com/article/finance/how-to-budget

- https://www.shopify.com/blog/cash-flow-management

- https://www.moneyfit.org/how-to-budget/

- https://www.truist.com/resources/commercial-corporate-institutional/manage-cash-flow/articles/10-steps-for-better-cash-management

- https://localfirstbank.com/article/budgeting-101-personal-budget-categories/

- https://www.ameriprise.com/financial-goals-priorities/personal-finance/personal-cash-flow-management-strategies